Toms Shoes' Fate Is Familiar to Mall-Based Retailers - Adweek |

- Toms Shoes' Fate Is Familiar to Mall-Based Retailers - Adweek

- Turns Out, Anti-Gun Virtue Signaling & Politics Don't Sell Shoes - AmmoLand Shooting Sports News

- One of the NBA's First Signature Shoes Is Back on the Street - InsideHook

- These E-Skates Seen on ‘Shark Tank’ Are Just Like Segways for Everyday Use - Footwear News

- Global Smart Shoes Market 2018-2022 | 23% CAGR Projection Through 2022 | Technavio - Business Wire

| Toms Shoes' Fate Is Familiar to Mall-Based Retailers - Adweek Posted: 06 Jan 2020 01:29 PM PST Philanthropic brand Toms Shoes proved as vulnerable to the retail apocalypse as any legacy mall-based brand, agreeing to an out-of-court restructuring more than a week ago. Toms Shoes was saddled with a roughly $300 million loan due in 2020, according to credit rating agency Moody's Investors Service. That debt was acquired when founder Blake Mycoskie sold half of his business to private equity firm Bain Capital in 2014, a transaction that reportedly valued the company at $625 million. Fast forward to late 2019 and the high leverage as a result of that deal consequently pushed the company to agree to a debt-for-equity swap with a group of creditors led by Jefferies Financial Group, Nexus Capital Management and Brookfield Asset Management. The Toms Shoes story began in 2006, when it was founded by Mycoskie. The company became famous for a canvas shoe inspired by a version commonly worn in Argentina called alpargatas. For every pair sold, the brand would donate another pair of shoes to a child in need. The company's philanthropic approach, which was also the centerpiece of its marketing and tied to founder Mycoskie's personal history, ultimately propelled it to rapid growth. But while Toms Shoes was generating more than $400 million in revenue annually by the time of Bain Capital's buyout, it was already experiencing a decline in the sales of its flagship canvas shoes, said Raya Sokolyanska, a vice president and retail analyst at Moody's. That created a problem for the company because the canvas shoe contributed higher margins than its other products. In order to grow, Toms was already adding new categories such as eyewear and coffee. But the expansion required more capital to invest in operations, further adding to its woes. Crucially, the philanthropic efforts that provided most of the company's marketing and differentiated it from competitors invited imitation, diluting Toms Shoes' appeal. Skechers, for example, launched a cheaper knockoff line of canvas shoes called Bobs Shoes. The one-for-one donation model was no longer unique, Sokolyanska said. Leverage at Toms Shoes grew to 10 times Ebitda (earnings before interest, taxes, depreciation and amortization) as of the second quarter of 2019, according to Moody's, while revenue for the 12 months ended June 30 declined to $299 million. The ratings agency deemed the capital structure unsustainable. Toms Shoes may serve as a cautionary tale for other brands. Though a pioneer of the one-for-one product donation strategy, Toms was not the first company to marry commerce with philanthropy. It followed in the footsteps of brands such as Newman's Own and Clif Bar, for example. Interestingly, neither Newman's Own, which is owned by a foundation established by founder Paul Newman, nor Clif Bar, which backed out of a deal to be acquired by a large food conglomerate, would end up selling, choosing instead to maintain their independence. Regardless, don't expect Toms Shoes to disappear. With the restructuring, the brand will get a $35 million cash injection from its new owners to support growth. Toms Shoes, Jefferies and Bain did not respond to requests for comment as of publication. |

| Posted: 07 Jan 2020 06:54 AM PST Opinion  USA – -(AmmoLand.com)- TOMS Shoes is getting a lesson in Business 101. The anti-gun corporate virtue signaling they have been deeply entrenched in doesn't pay the bills. According to recent news, the Los Angeles-based company's creditors are taking over TOMS in exchange for restructuring its debt. In a letter to employees, TOMS CEO, Jim Alling apparently shared the news that the deal will help the company deal with a $300 million loan due next year and will mean a new $35 million investment in the company from the new owners. Two Left Feet Last year at this time, TOMS was making news for its new gun control campaign, centered on getting Congress to approve flawed Universal Background Check legislation. In addition to direct lobbying, the campaign also involved a $5 million corporate contribution to gun control advocacy groups, a cross-country tour culminating in a rally and efforts to promote grassroots lobbying among customers. One year later, we know that enough members of Congress were brave enough to reject the emotionally-charged legislation, which would have had no effect on the criminal misuse of firearms. TOMS campaign failed. Customers didn't run out to buy TOMS products in response to their corporate support for gun control. Unfortunately for TOMS, the business is now struggling. It's easy to see why any company, especially one based on social activism like TOMS, would want to weigh in on issues in our country and be seen as a virtuous member of society. The firearms and ammunition industry shares the goal of reducing the criminal misuse of firearms and has created a number of programs over the years to help address unauthorized access to firearms and to promote safe handling and storage practices. A Mile in Our Shoes The firearms and ammunition industry prides itself on high rates of safety and regulatory compliance. Our voluntary programs, often in partnership with state and federal government agencies, help to curtail the actual problem of guns getting into the wrong hands. We work to make sure states are submitting all prohibiting records to NICS. We provide millions of free gun locks and educational materials in all states. We train firearms retailers to spot straw purchasers, to comply with all laws, to use discretion when making transactions, and in how to keep their inventory secure. We work with the Department of Veterans Affairs and the American Foundation for Suicide Prevention to help address the tragedy of suicides in our country. In short, we know it's time for Real Solutions. Safer Communities to help continue the trend of reducing both violence and firearms accidents in our country. The firearms industry welcomes other companies in whatever industry to join us in our efforts. So, instead of lobbying for ineffective, irrational gun control policies, perhaps TOMS management should focus on selling shoes.

The National Shooting Sports Foundation is the trade association for the firearms, ammunition, hunting and shooting sports industry. Its mission is to promote, protect and preserve hunting and the shooting sports. Formed in 1961, NSSF has a membership of more than 10,000 manufacturers, distributors, firearms retailers, shooting ranges, sportsmen's organizations and publishers. www.nssf.org |

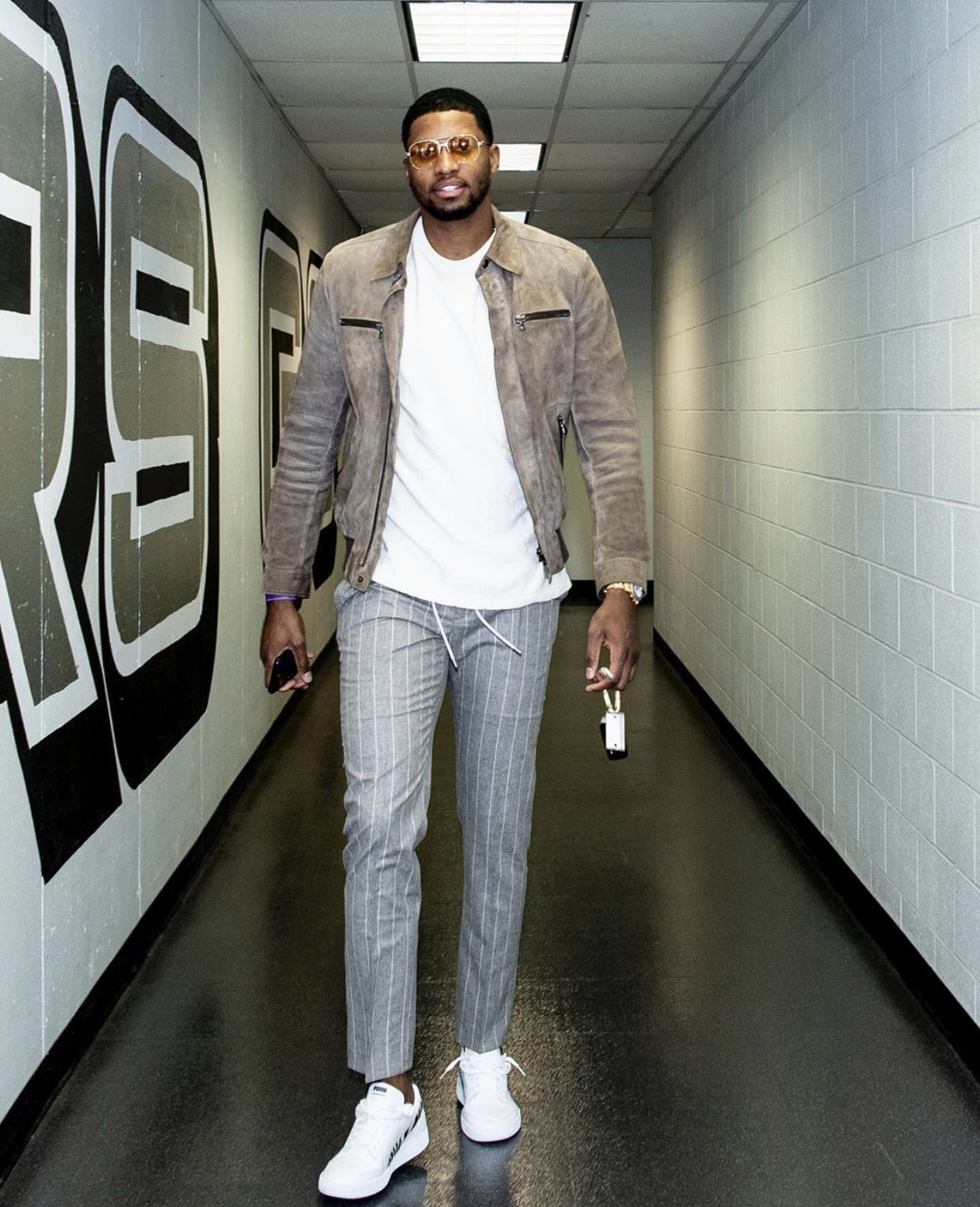

| One of the NBA's First Signature Shoes Is Back on the Street - InsideHook Posted: 06 Jan 2020 03:13 AM PST  Ralph Sampson poses with his signature PUMA shoe. (Bob Levey/Getty Images for PUMA) Born in Harrisonburg, Virginia, in 1960, Ralph Sampson started growing like a weed while he was practicing his jump shot. In addition to getting taller by the day, the hotshot hoopster's foot size grew with each passing year and, by the time he was 17, so was his shoe size. A standout player for four years at The University of Virginia, Sampson was able to find success on the basketball court despite struggling to find a shoe that would fit him, often resorting to combinations of different socks to find something that was somewhat comfortable for his long yet narrow feet. Luckily, by the time Sampson was taken No. 1 overall in the 1983 NBA draft, relief was on the way. PUMA, which was already represented on the NBA hardwood by Walt "Clyde" Frazier, inked Sampson to a deal and began making his signature shoe, the Majesty, which made its NBA debut at the same time Sampson did: two days before Halloween of 1983.  Clad in his Majesties, which had been designed to account for Sampson's arch as well as the narrowness of his feet, Sampson took the court (wearing an extra pair of socks just in case) and went for 18 points with 12 rebounds, three assists and four blocks against 7'2″ San Antonio Spurs center Artis Gilmore. "It made a big difference," Sampson tells InsideHook. "It was amazing because it was my first official NBA game, but also because I had my own shoe that had my name on it. First game, first time wearing the shoe. I had just gotten them, maybe two weeks before and I just broke them in a little bit while we were in practice. It was one of those moments you never forget. That was the start of the Majesty and the rest is history." That history includes a nine-year NBA career that saw Sampson be named Rookie of the Year, make the All-Star team four times and take home All-Star Game MVP honors in 1985. Not required to dress up for games the way NBA players are today, Sampson would instead don one of the 100 sweatsuits he owned on game days and coordinate with the pair of PUMAs he'd be wearing to take the court that night.  Though he no longer wears his sweatsuits all that much, his signature PUMAs are still a staple on his feet. "The pants used to be wide, but they're a bit narrower now," he says. Though the original Majesty shoes that were first released during the 1984-85 season became a highly coveted rarity among sneakerheads after eventually being discontinued, PUMA recently introduced a new version of the shoe in both high and low top that's popped up on the feet of current NBA players like Rudy Gay, Danny Green and Terry Rozier. "I've seen the evolution of PUMA getting back in the business, but I didn't know they were coming back and going old school," Sampson says. "I saw them sign Clyde Frazier, and I'm like 'Oh, that's pretty interesting because Clyde's iconic in his own right and they gave him a lifetime contract.' Then they called me and told me they were bringing my shoe back. I was extremely excited to just be back in the arena. Now it's 'cool' to wear a Ralph Sampson shoe from the '80s. It kind of brings me back to the forefront of the sports world with basketball. People always said I was ahead of my time."  So, what's it like to be synonymous with a signature shoe and brand the way Michael Jordan is with Nike and Stan Smith is with Adidas? "I tell people all of the time that PUMA was the icon company that started all of this stuff," Sampsons says. "It wasn't Nike, Jordan Brand, Under Armour, Adidas, or any of that. PUMA started it and are now back in it and I think they'll keep it going. Jordan Brand and all of that stuff is cool and they had the right timing with Michael, but it doesn't have the same culture and the same start that PUMA has. It doesn't have the history that PUMA has and they'll never have that –– obviously in my opinion. It makes me never forget that the sky is the limit." |

| These E-Skates Seen on ‘Shark Tank’ Are Just Like Segways for Everyday Use - Footwear News Posted: 06 Jan 2020 02:02 PM PST  Looking for the fast track to work or school? Consider a pair of Zuum shoes, self-balancing e-skates, whose founders went in front of ABC's "Shark Tank" team last night in search of an investment in the company. They were seeking an investment of $125,000 for a 20% stake in the company. Although the founders of the Portland, Ore.,-based company did not secure any funding, that didn't stop consumers from racing to the website for a pair of their own. The shoes come in a single style and retail at a special Shark Tank price of $299 both (compared to $499) on Amazon.com, that ends tonight. Zuum Technologies was founded in 2018 by entrepreneurs Chico Guerra and Mason Buechler, who made the pitch on the show. According to the company, its goal is to reinvent the way people think about traveling, from having fun around the house to neighborhood trips. They can even be toted on vacations for on-the-spot transportation. Since the company is also committed to protecting the environment, the shoes eliminate any emissions. And, since traffic congestion is escalating in cities around the country, Zuum offers an alternative to gas powered vehicles. They can achieve a top speed of 8 miles per hour, with a ride time per charge of 1 ½ hours. When planning an outing, keep in mind it takes two hours to charge. The shoes weigh 7 pounds each. They can navigate on a range of services and can be worn by adults and kids. Here's how to get started. Turn the skates on using power buttons on the side of each device. Next, place your dominant foot on one of the shoes. Once balanced, place your other foot on the second skate. Gently lean forward to go forward, and lean backward to move backwards. Zuum is not the first footwear company to appear on "Shark Tank." Others include ISlide line of slides, Solemates heel protectors, Xero Shoes and kids' brand Freshly Picked. While some inked deals, others turned down offers.

Want more? The 'Shark Tank' Effect: Where Are These Shoe Companies Now? Inventor of Heel Protectors Talks Appearing on 'Shark Tank' These Customizable Slides Will Appear on the 'Shark Tank'; Season Premiere Airing Sept. 23 Watch on FN |

| Global Smart Shoes Market 2018-2022 | 23% CAGR Projection Through 2022 | Technavio - Business Wire Posted: 07 Jan 2020 02:00 AM PST LONDON--(BUSINESS WIRE)--The global smart shoes market is expected to post a CAGR of almost 23% during the period 2018-2022, according to the latest market research report by Technavio. Request a free sample report The popularity of fitness activities is leading vendors in the global smart shoes market to invest in cutting-edge technological innovations. Products such as step-counting shoes are gaining popularity among consumers as it helps them monitor and plan their physical activity. This is leading vendors to market their products as premium variants and adopt effective branding strategies to retain and expand their customer base. Branding is crucial as most existing players offer products with relatively similar features. Also, the global recognition of a brand logo implies wider acceptance of the brand, which helps in retaining the market position of the brand. This will accelerate the demand for premium products and help market players increase their revenues. To learn more about the global trends impacting the future of market research, download a free sample: https://www.technavio.com/talk-to-us?report=IRTNTR20861 As per Technavio, strategic partnerships will have a positive impact on the market and contribute to its growth significantly over the forecast period. This research report also analyzes other significant trends and market drivers that will affect market growth over 2018-2022. Global Smart Shoes Market: Strategic Partnerships Vendors in the market are forming strategic alliances with technology giants to develop smart shoes with various features. For instance, in 2017, Li Ning collaborated with Xiaomi to launch smart shoes equipped with military-grade motion sensors. Similarly, in 2017, Brooks collaborated with HP to introduce personalized running shoes based on foot biomechanics. This trend is expected to boost the growth of the global smart shoes market during the forecast period. "The growing provision of personalized fitness coaching and the increased use of wearable devices in sports analytics will further boost market growth during the forecast period," says a senior analyst at Technavio. Register for a free trial today and gain instant access to 17,000+ market research reports. Technavio's SUBSCRIPTION platform Global Smart Shoes Market: Segmentation Analysis This market report segments the global smart shoes market by function (step-counting smart-shoes, positioning smart shoes, navigation smart shoes, and auto-tightening smart shoes), end-users (adults, senior citizens, users with disability, and kids), distribution channel (online and offline), and geography (Americas, EMEA, and APAC) The Americas region led the market in 2017, followed by EMEA and APAC, respectively. During the forecast period, the Americas region is expected to maintain its dominance over the market. Technavio's sample reports are free of charge and contain multiple sections of the report, such as the market size and forecast, drivers, challenges, trends, and more. Some of the key topics covered in the report include: Market Landscape

Market Sizing

Five Forces Analysis Market Segmentation Customer Landscape Geographical Segmentation

Market Drivers Market Challenges Market Trends Vendor Landscape

Vendor Analysis

About Technavio Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios. |

| You are subscribed to email updates from "shoes" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

About The National Shooting Sports Foundation

About The National Shooting Sports Foundation

0 Yorumlar